Rebuild your credit fast — see real results in as little as 45 days with our proven system!

Credit Repair That Works. Fast & Reliable With Proven Strategies.

Welcome to Elevation Financial Services, your dedicated partner on the path to financial freedom.

Our mission is to guide you through the credit landscape with the tools, strategies, and knowledge you need to eliminate debt and build long-term financial security.

What We Can Remove:

Foreclosure Accounts

Collection Accounts

Medical Debt

Student Loan Issues

Judgments

Late Payment History

Vehicle Repossessions

Public Record Items

Child Support Reporting

Bankruptcy Records

Hard Credit Inquiries

Why Should I Care About What's On My Credit?

Your credit plays a major role in your financial life. Credit is essentially your ability to receive goods or services now, with the agreement that you will pay for them later. Lenders use your credit score to evaluate how risky it may be to lend you money.

A higher credit score can qualify you for better interest rates, lower monthly payments, and overall more favorable terms for future loans and financial opportunities.

What Is a "Credit Report"?

Think of your credit report as a financial report card. It shows how well you manage your financial obligations.

Your report includes:

Negative items such as collections, bankruptcies, repossessions, and past-due accounts

Positive information like on-time payments and solid payment history

This snapshot of your financial behavior is what lenders review when deciding whether to approve you for credit—and at what terms.

Living with bad credit can be difficult, but it's manageable—and it's not permanent.

Here’s What Life With Bad Credit Can Look Like — and the Challenges You Might Face

Bad credit, usually defined as a credit score below 580, can impact multiple areas of your daily life. Here’s how:

1. Limited Financial Access

Loans & Credit Cards

Approval becomes difficult, and if you are approved, the interest rates are typically much higher.

Renting a Home or Apartment

Most landlords run credit checks. Poor credit may lead to higher security deposits or even denial of your application.

Utility Accounts

Electric, water, or internet providers may require upfront deposits before opening an account.

Auto Financing

Car loans may come with steep interest rates or require a co-signer.

2. Employment Concerns

Certain employers—especially those in financial, government, or security-sensitive roles—may review your credit report as part of the hiring process.

Negative items can raise concerns about financial responsibility.

3. Higher Insurance Costs

In many states, insurance companies use credit-based insurance scores to determine premiums for auto and home insurance.

Lower credit often results in higher monthly insurance costs.

How to Cope With and Improve Bad Credit

Pay Your Bills on Time

Your payment history is the most important factor in your credit score. Setting up reminders or automatic payments can help prevent late payments and avoid unnecessary fees.

Reduce Your Debt

Prioritize paying down credit card balances, especially those that are close to their limits. Lower balances can quickly improve your credit utilization ratio.

Consider a Secured Credit Card or Credit Builder Loan

These products are designed specifically to help you rebuild or establish credit. They provide a safe way to show positive payment history.

Limit New Hard Inquiries

Avoid applying for multiple new credit accounts at once, as each hard inquiry can temporarily lower your score.

Bad credit can feel overwhelming, but it is absolutely fixable. With consistent habits, smart strategies, and the right guidance, you can rebuild your credit and regain financial confidence.

If you’d like, I can create a personalized action plan tailored to your specific credit situation.

Living with good credit opens up many doors and makes daily life a lot easier—and often, less expensive. Here’s what it looks like, why it matters, and how to maintain it.

What Good Credit Looks Like

A good credit score is typically 670 or higher (with scores above 740 considered very good and 800+ excellent). It means you’ve shown lenders you’re a responsible borrower.

Benefits of Having Good Credit

1. Lower Interest Rates

With strong credit, you qualify for better rates on credit cards, auto loans, mortgages, and personal loans—saving you thousands of dollars over time.

2. Faster and Easier Loan Approvals

Lenders view you as a low-risk borrower, which makes approvals smoother and quicker when you need financing.

3. Access to Better Credit Card Offers

Good credit opens the door to premium cards offering higher limits, cash-back rewards, travel perks, and even 0% introductory APR periods that can help manage large purchases or balance transfers.

4. Easier Renting or Buying a Home

Landlords and property managers prefer tenants with strong credit histories. Good credit increases your chances of approval—often without needing a co-signer or a large security deposit.

Pro Tip

Great credit gives you negotiating power. Use your strong score to request better loan terms, lower rates, or improved perks when refinancing or applying for new credit.

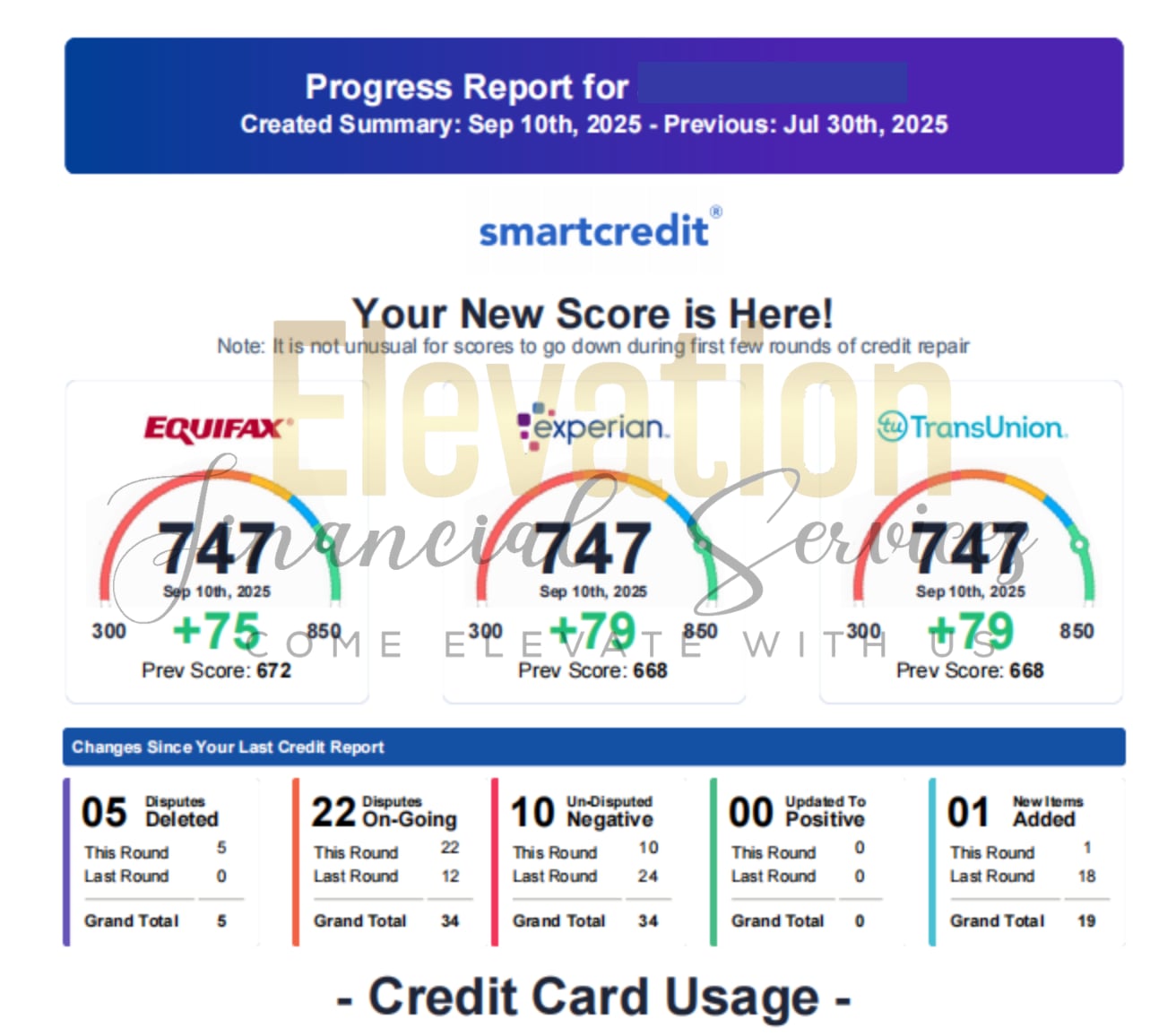

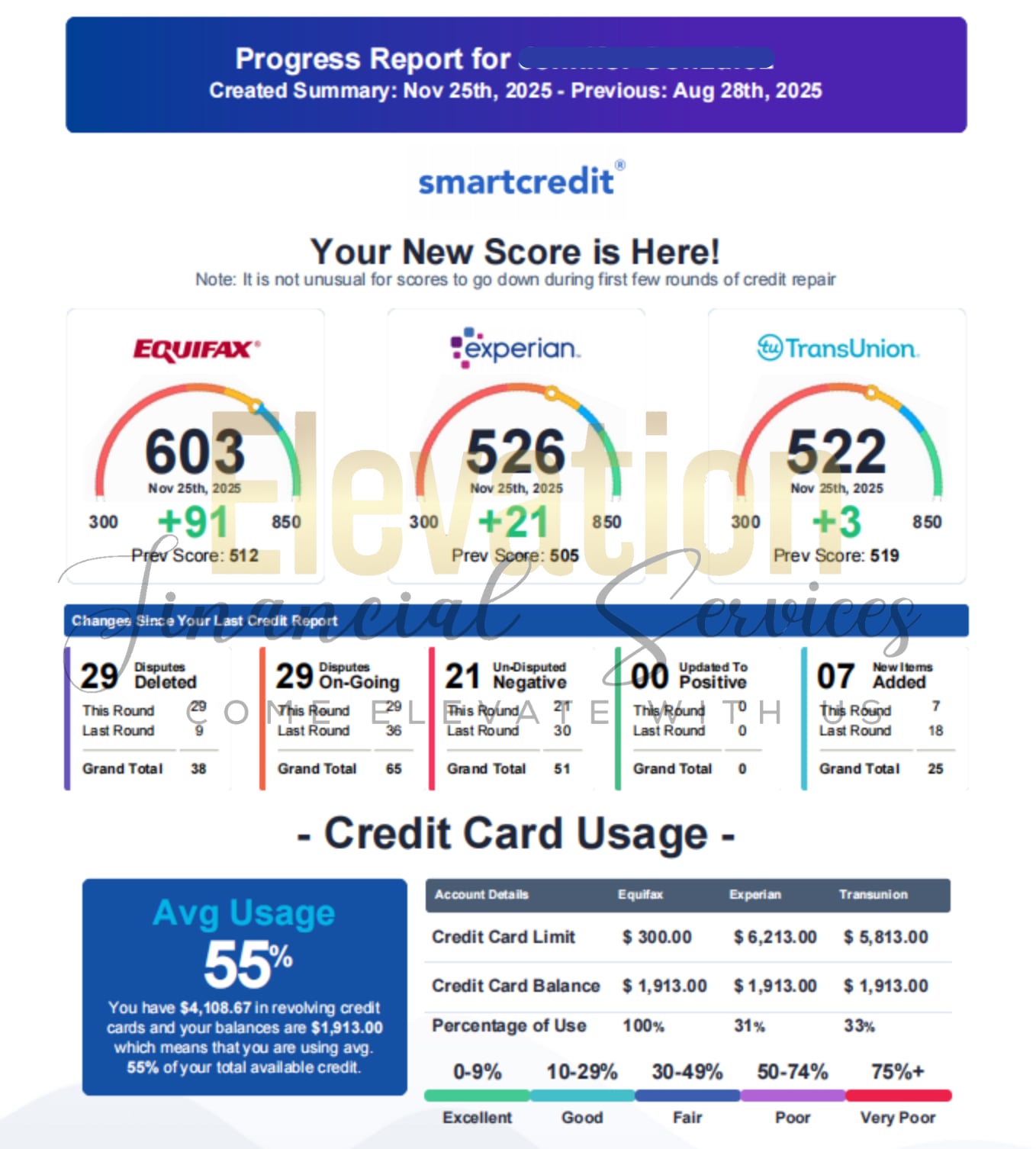

Clients Results

I’m Ebony Brown strategist, tax professional, credit authority, and the builder behind the movement of elevation. I help everyday people rewrite their financial story with clarity, confidence, and control.

My work lives at the intersection of taxes, credit, business, and legacy. I don’t believe in temporary wins I build foundations that last. Through Elevation Financial Services, I guide individuals and entrepreneurs through tax preparation, credit transformation, business positioning, and funding strategies that open real doors to real opportunities.

I lead with integrity.

I serve with intention.

And I believe financial freedom is built not wished for.

Whether you’re filing, rebuilding, or ready to scale, my team and I are here to move with you step by step, strategy by strategy into your next level.

This isn’t just about taxes or credit.

This is about confidence.

This is about capacity.

This is about elevation.

Let’s build your future on purpose, with power.

At Elevation Financial Services, we understand that the true value of your business lies beyond the numbers. That’s why our focus is on clarity, strategy, and precision — helping you make financial decisions with confidence and control.

Have questions or need to schedule a mobile notary?

📞 Call or Text: 903-707-5127

📧 Email: [email protected]

🖥️ Or use our online booking form for quick scheduling.

Copyright© 2025 Elevation Financial Services All rights reserved. Powered and Designed by MJ Martinez